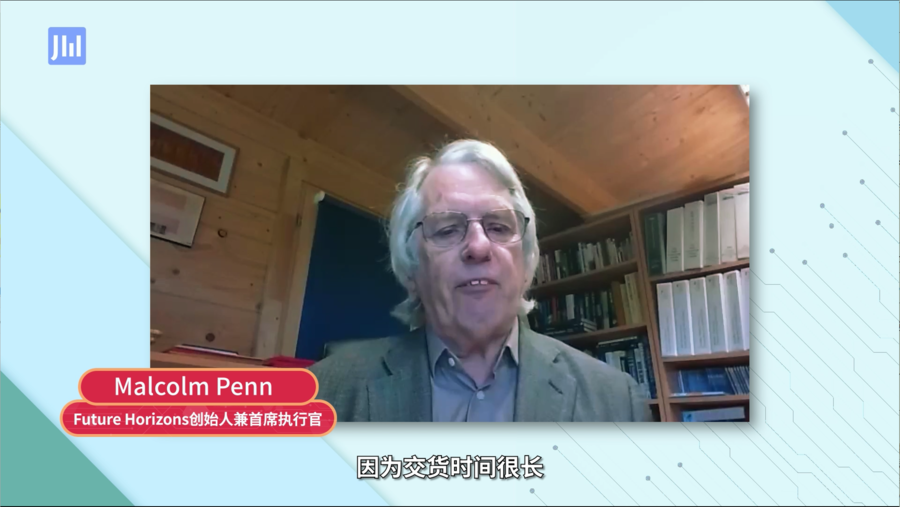

在往期的集微访谈栏目中,爱集微有幸采访了Future Horizon创始人兼首席执行官Malcolm Penn。集微访谈就关于半导体市场周期、市场变化逻辑、对2023、2024年市场行情预测等一系列问题,收到了十分有启发的答复。

问:那么与其他咨询机构相比,你们对2023年半导体市场营收的预测是最悲观的,那么市场中哪些因素让你们做出这样的预测呢?而且,为什么各机构的预测存在如此巨大的差异?

答:我认为2021年和2022年市场出现短缺的根本原因是需求与产能不匹配。事实上,这就是造成供不应求或供过于求的原因,无法平衡供需是因为交货时间过长,在工厂制造晶圆需要时间,通常需要4个月或者甚至6个月,这取决于各方的复杂程度,即使非常简单的晶圆也需要3个月的制造周期。

因此等待交货需要很长时间,可能需要3个月、4个月、5个月甚至6个月,前提是拥有足够的产能。如果没有产能,那么建造新设施至少需要一年的时间。如果没有工厂,那么则需要两年的时间。因此,如果没有提前下订单,那么你可能需要等待2或3年才能获得所需零件。

需求不会消失,事实上需求只会越来越强烈,因为人们通常会超额订购,即订购量大于实际需求量。由于交货时间太长,人们会加倍订购量,工厂因此就必须要保持生产线的运行,因此很难平衡供需。

在整个行业历史上,我们没有完全做到过供需平衡,因为我们会遇到需求突然激增的时期,比如在2021年疫情封控期间,我们不能外出,只能在家远程办公,我们不得不购买计算机、电视、娱乐系统等设备,这导致需求剧增,而行业无法应对这种情况,所以立即陷入了供不应求的局面。

现在则恰恰相反,出现了供过于求的局面,当产能突然增加时,所有的产品都开始上线,然而顾客却突然想到,“等等,我已经拿到了自己需要的所有零件,但我却超额订购了”,于是他们开始削减订单,并消耗自己的库存,因此客户不再有购买需求,因为他们已经在一年前买过了。这就意味着需求突然消失,从而自动导致了产能过剩,因为现在是有产能但无需求。

突然之间,工厂会变得空荡荡,近乎空无一物,为了填补工厂的空缺,人们要做的第一件事就是降低价格,就会出现需求下降、平均价格下降的情况,两者将加速收入下降。这就是为什么总会出现急剧增长和急剧下降的情况。简单地说,这是市场周期调整的结果,这种周期性调整体现在曲线上通常十分陡峭,从而会出现两位数的剧增和两位数骤降的现象。

我认为正是这种信念和对此信念的坚定才让我们与众不同,相比之下其他人可能没有我们这么勇敢,他们会试图减少负面消息带来的影响,来说服自己这只是轻微的或适度的,不会持续很长时间。但事实上,这种做法并不能解决问题,因为生产周期很长,交付时间无法缩短。

事实是这是行业基因的一部分,也是行业运作方式的一部分。我们敢于公开说出自己的想法,这可能是其他人没有的勇气。我们很幸运,拥有独立自主的地位,因此无需向老板交代,客户就是我们的老板,我们可以向客户解释我们为什么有这样的看法,他们可以选择认同或者不认同。

但至少我们能够坚定自己的立场,我们不必回答董事会、投资者和股东的问题,不必考虑这些事情。我们可以直言不讳地表达对行业的看法、观察到的情况以及得出结论的原因。

现在,你可以自行评判我们的观点是正确的、悲观的还是乐观的。我们会告诉你原因和事实,并解释我们得出这个结论的原因。我们非常有把握,因为我们并没有使用过去17年或50年的历史数据,也没有使用以前的衰退和上涨情况来证明为什么这次会不一样?什么样的因素使得这次与以往不同?

问:尽管您表示现在绘制2024年的增长数据还为时过早,那么您能否根据当前的市场情况给出一个粗略的估计?

答:是的,我认为如果一切顺利,按照预期进行,明年的增长率应该会保持在个位数的低水平。因此,如果我必须猜测,我认为第一年复苏的典型增长率大约在4%到6%之间,第二年则会有较强的增长,可能进入两位数的低水平范围。

这将是复苏曲线的正常形状,在今年9月的预测中,我们会更清楚地了解到确切的数字。那时我们将做出坚定的承诺,但我们认为这个数字是……但是,我希望此时的增长率应该在个位数的低范围内。当然,如果经济在下半年崩溃,那将会稍微推迟一些,因为我们还不确定今年会如何发展,但今年的发展方式将影响未来的数字走向。

其中的实际动态不会改变,仍将呈现逐步重建库存、重新思考供应链、逐步减少过剩产能、平均销售价格缓慢上涨等的渐进过程,所有这些都是一步一步缓慢积累起来,从而增加出货量,所以,问题只是在于这个过程发生的速度是快还是慢。

我们认为,这个过程会以中等正常的速度发生,增长率可能是4%到6%,或许是8%,但我对8%表示怀疑,但肯定是4%到6%之间的范围。因此,我期望预测的三种情况将在6%之间,最坏情况下为4%,而在牛市即非常乐观的情况下可能达到10%。

问:您已经经历过 15、16 或 17 次行业严重衰退。那么您如何看待这一次的低迷呢?就像一个问题,你知道,这对未来市场有何影响?

答:是的,正如我之前提到的,市场衰退总是由供需不匹配引起的。一旦出现产能过剩的情况,当你从产能过剩转变为产能不足,或者从产能不足转变为产能过剩时,我向客户运输的货物数量总会突然发生变化,这并不是需求发生了变化,因为我们所运输的货物和需求是两回事。

其中还要加上库存量增加或减少带来的影响,因为库存调整发生在供需之间,实际需求并没有变,但购买量和订购量将会截然不同。库存调整是实际需求量加上额外的库存量,以保证供应链正常运作,或者因为库存太多而缩减库存量。

我认为这种情况总会发生,这是每个周期的典型特征。而这个周期和以往的18个周期没有什么不同,直到行业能够更好地平衡供需,这是一个相当复杂的问题。我们无法预测这在何时或如何发生,因为这与行业的运作方式相反。

因此,我认为情况都是一样的,市场衰退总是由库存清算、价格下跌等因素所驱动,随着清算库存,人们需要购买更多的货物,从而推动需求重新增长,工厂再次充满活力。

与此同时,由于产能过剩,你停止了投资,这将启动下一个周期。因此,我认为情况总是有微妙的不同,不是所有产品的反应速度都一样。比如,存储器总是反应最快,随后是微处理器、逻辑电路,而模拟电路总是在周期中最后一个作出反应。

同样,存储器总是第一个恢复的,然后是微处理器、逻辑电路,最后才是模拟电路,并不是所有的行业都是不同的,有些行业在反应速度方面与其他行业相似。因为你会发现一些行业能够更快地做出反应,例如个人电脑和消费品行业。而汽车行业则需要更长的供应周期,因此反应速度较慢。

我认为每个行业都是不同的,每个产品也都是不同的,但它们都遵循着同样的节奏,共同前行,只有微小的时间差异会真正影响整体情况。

问:那么在这次经济衰退的背景下,您有什么话想对投资者和行业上下游企业说呢?

答:是的,我认为真正的信息是要从历史中吸取教训,因为历史是预测未来行为的可靠指标。但总的来说,世界并不擅长从历史中吸取教训。我们总想着这一次会有所不同,总是相信会出现这种情况是有真正原因的。

但实际上,这一次确实有所不同,因为它遵循着自然的思维过程和动态变化,除非你改变了这些动态,否则结果不会改变。如果想要不同的结果,就必须采取不同的行动。

我们的行为方式与过去完全一样,因此,我认为我要对客户、投资者和整个产业链中的所有人强调一件重要的事情,那就是要关注自然现象,不要过于复杂,也不要过度思考,要观察实际发生了什么事情,了解我们在周期中处于什么位置?回顾以前发生了什么?那将如何影响未来发生的发展趋势?

在观察这些因素时,要牢记这些因素,并寻找这次与之前的差异、变化,以及它如何微妙地不同于以前的情况?但在你脑海中已经有了潜在的主题,所以你真正想知道的是这一次它如何微妙地解决问题。但正如我们所看到的,这次下降与以前的经济衰退一样,因此它几乎不可能有所不同。

我们目前连续三个季度处于调整期,与过去17次衰退中的每次表现都完全相同。因此,复苏很可能也会采取完全相同的方式,因为我们最终必须清算库存。

因此我们必须购买更多的零件,不再依赖库存,而是依靠我们的订购量,这将自动增加订单量,防止价格下跌,因为需求突然增加了。在这种情况下,价格将停止下跌,甚至可能开始上涨。

如果这种情况发生,你就会进入一个良性循环,并最终吸收所有过剩产能。那时候,你可能会突然发现,“我没有足够的产能,交货需要耗时2年”。所以,在我们学会根据自身需求建立产能之前,永远无法缓解供需之间的不平衡。

我们曾经这样做,但现在不再采用这种方式,因为人们负担不起建造昂贵的工厂,也不知道要把产出卖给谁。而客户不愿意承诺未来购买产出,比如说两年后保证购买,他们并不了解未来情况,所以这是一个无解的方程式。

问:您已经预测 1 月和 3 月市场收入将下降 22%。然而,我们也注意到您在 5 月份小幅回撤了 2%。第一季度的哪些因素促使您做出这一决定?

答:说实话,我们其实并没有修改我们的预测。我们认为原始数字本身就可以准确地给出未来趋势的框架。我们总是会先做出一个预测,即我们认为未来会发生的事情,然后再根据当年实际情况评估预测的准确性。如果出现了真正戏剧性的事情,我们会修改预测吗?

因为我们认为应该根据最初做出的承诺来评估我们的表现,而不是不断更改预测来获得正确的数字,如果每个月都不断调整数字,那么任何人都可以得到正确的数值,这是不可取的,我们坚信我们的客户是公正的,可以看到这一点。

因此当我们做出了22%的预测时,其实我们在18个月前就已做出这个预测,有趣的是,当时我们正在预测和研究衰退对供需平衡的影响,并期待该行业采取一些行动。正如你所说,我们在1月和3月再次确认了这个预测,并认为这个数字仍然是可靠的。

当时真正的区别在于,它是否会变成负数?很多人当时认为不会变成负数。现在,人们普遍认为会变成负数,但只有5%或6%的人这么认为。我们仍然认为将出现双位数负增长的情况,这完全取决于最后的计算结果。这是一个数学问题,我们最初预测第一季度会萎缩10%,但就范围而言,我们预计可能会萎缩-8%至-12.5%。

正如它发生的那样,目前第一季度表现稍微强劲一些,第一季度的下降幅度只有-8.2%,更接近我们预测的-8%,我们认为这是最好的结果,第一季度的情况倾向于我们之前预测范围内偏积极的一面。然后我们预测第二季度会是-6%,但目前还不确定,因为人们对第二季度的情况看法不一。真正让我担心的事情以及我们没有改变预测的原因是台积电的预测,台积电预计销售额下降的范围在9%至4%之间,这是一个很大的范围。

-4%至-9%的下降幅度是一个巨相当大的范围,这说明台积电面临的情况不确定,并且台积电可以视为整个行业的预警。我们确信我们正在走向市场衰退的底部,该衰退始于去年6月,所以我们已经度过了两个季度、三个季度。

通常情况下衰退会持续四个季度,也就是一整年,所以我们现在正处于第四个季度。我们预计整个情况会得到控制,开始重新调整并触底反弹,但实际上连续下滑的最终结果会是什么?会是-2%、-6%还是-8%呢?我们暂时无法确定。因此,根据当前的情况,我们认为可能会在-7%这个数量级的范围内。

如果情况的确如此,那么我们的预测实际上是-5%。因此,如果把这种情况应用到全年,可能会达到-20%,与我们之前预测的-22%相比略有偏差。但我们向整个行业传达的信息是,今年的情况不会降至个位数,我们不会让今年的走势下滑到很低的负数,比如-5%、-6%甚至-10%。因为要达到这么低的水平,市场在第二季度就必须开始复苏,但这是不可能发生的,市场必须在第二季度开始积极转变,才有可能实现数字在个位数区间内。

因此,我们非常确信,这种情况不会发生,因为如果真的出现了这种情况,其实现在已经快到6月份了,接近第二季度末了,但没有人站出来说,嘿,市场已经转好,一切都好起来了,所有货物都超额配送了,这是一件很棒的事情,没有人这样说。因此,第二季度肯定不会成为正数。而如果第二季度不是正数,那么整个年度就不可能是取得个位数的负数。

因此,这不仅仅是一个数字。数字虽然非常明显,但数字背后传达的信息才是真正重要的,即发生了什么事情?我们目前处于周期的哪个阶段?我们期望这种情况发展成什么样?我们预计这种情况在一年中会如何发展?在过去的18个月里,这种情况根本没有发生任何改变。

实际上,我们所说的将要发生的事情正在发生,可能是一天、一周或是一个月,时间的长短取决于各种动态因素。然而,这场衰退的本质以及随后的复苏的本质,正在遵循着众所周知的规律和成熟的行业模式。

问:所以你已经表示今年第一季度更接近你之前预测的牛市。最糟糕的 -26% 不太可能,现在不太可能,所以你过去,你仍然强调实质上没有任何真正改变,这部分是什么意思呢?为什么你认为它没有真正改变?

答:是的,该行业的内在动态实际上并未发生变化。我们的全面预测是基于经济在整个时间段内不会恶化,只是通过周期性的自然进展来推动的。我们对未来存在一些不确定性,所以我们将预测已略微调整为消极的状态。

事实上,我们高度关注全球应对通货膨胀而采取的措施导致利率上升,以及这可能对消费者支出能力甚至企业产生影响的问题,因为他们正在努力弥补日益增长的利息支出和成本,同时面临可支配收入的减少。

在周期的末端,我们预测的-26%实际上是基于这样一个事实,即我们担心全球可能在今年下半年真正进入衰退。这就是为什么我们 会说,如果全球经济在今年下半年陷入衰退,那么预测就会接近-26%。如果全球没有陷入衰退,一切都非常顺利,情况非常乐观,那么预测范围在-18%之间。

我认为差异实际上就在于这个未知因素,即在此期间经济会如何反应?我们认为,供求和其他行业掌握的问题将推动经济达到中间范围-22%。但如果经济状况稍强,那么预测将略向左移;如果经济状况较弱,并且在今年下半年进入衰退,那么预测将趋向最糟糕的-26%。

问:所以从全球经济的角度来看,现在最大的区别是今年下半年将会发生什么?

答:目前还无法确定,我的意思是,是否存在问题取决于你与谁沟通。到目前为止,美国相对来说没有受到太大的影响,需求依然强劲。但另一方面,仍然存在很多不确定性。

我们经历过几次小规模的银行危机,利率和高通胀的问题仍然存在,失业率太低,所以他们试图调节通货膨胀的所有举措目前都没有奏效,如果他们不得不加速解决使世界陷入衰退的不利因素,全球范围内将产生一定的连锁效应。

因此,现在仍非常不清楚,经济学家也无法确定,这仍是一种风险。这不是可能性,而是需要引起关注的风险。因此,针对这个问题,我们要向投资者传递的信息是:必须密切关注经济风险,必须关注产能风险,因为我们仍在建设产能,即使我们不需要它,但我们并没有停止产能。

你必须考虑这两个因素,因为它们将是关键决定因素。我们建立的产能越多,就需要更长的时间来吸收。经济状况越糟糕,对需求的压制力就越大。因此,这两个真正未知的变量是方程中的关键,而其他事情正在按计划进行。

我们正在清算库存,库存正在下降,单位出货量远低于自行修复的单位需求水平。价格已经触底,并且不再大幅下跌,因此出现了底部反弹的迹象。因此,所有这些事情都在按照预期的方式进行,但我们不知道需求将会受到怎样的影响,是否会因为今年下半年的经济衰退而受到冲击。

问:还有像现在的大环境,所以您之前提到,2022年半导体行业最不利的因素就是产能的同步增加和市场需求的疲软。您认为2023年第一季度的复苏是否预示着市场需求的大幅复苏?还是预示着大环境发生了一些变化?

答:我认为第一季度并没有我们想象的那么糟糕,这可能是因为库存清算花费的时间比以往更长。

出现这种情况的一个原因是由于这次情况与以往有一些结构性的差别。在经济繁荣时期,我们与客户签订了很多长期价格和供应协议,许多公司试图坚持这些协议,当允许公司减少货运量并推迟不可避免的事情时,这种做法就被排除了,最终这些协议会被取消,只是时间问题而已,所以客户坚持价格或单位运输协议,从某种意义上来说是自己给自己设的目标, 因为他们根本不需要已经购买过的零部件。

因此,在某个时间点,客户不会再购买这些零部件。这只是把购买时间向后推迟了一点,因此相比于正常情况,单位需求量实际上需要更长的时间才能降到趋势线以下。这有助于保持之后的单位货运量,有助于保持价值稳定,但在某种程度上这有点不真实。这种情况在第二季度开始发生,第二季度开始急剧下降。

在这方面,我认为没有什么真正的变化,使得整个情况与之前有任何真正的不同,唯一的原因就是我们签订了这些长期价格协议,所以导致了这种情况的发生。我认为许多领域,如逻辑电路,现在都是用水做成的,都是片上系统类型的零件,这些都有很长的工厂交货时间,在晶圆工厂的时间至少需要4个月,甚至可能长达6个月。

这意味着即使在去年6月或7月你想要减少产量,实际上也做不到,因为工厂已经满载了你的零部件,你只能选择把它们报废扔掉,或继续生产直到用完,而这可能要等到12月或1月。

因此,这种情况延迟了单位库存调整的时间点,这是一种结构性差异,与上一次略有不同,因为现在更多是定制零部件,所以,你的工厂已经承诺生产这些零部件。如果将其报废,那么就需要有人支付这些废料的费用,否则你只能继续生产,并在以后再进行调整。

问:关于英国芯片法案。英国政府投资 10 亿英镑的半导体行业支持计划,那么您的理解?

答:但我认为他们并没有真正称之为芯片法案,因为这会让它进入与中国、美国和韩国等世界其他国家类似的情况。

如果你把英国投入的10亿美元与中国3年、美国5年、欧盟十年的内500亿美元相比,那显然是微不足道的,但我认为这就像苹果和橘子无法进行比较一样。你需要知道的是英国在很长一段时间内实际上缺乏其高科技企业的战略,包括半导体。

在很长一段时间内,我指的是30年左右,英国在一定程度上支持其研究和开发工作,英国对研究提供了很多支持,而在那之后,会涌现出大量的世界级技术,其中很多被世界一流的企业购买,因为这些技术非常优秀。

我认为他们想要通过这个10亿英镑的投资,试图协调一下我们在研究方面做了什么?我们能不能提高其水平,将其转化为一个生产线示范项目,使它在价值链上向上提升一个级别,并要求用户决定应该做什么?我们应该大批量生产吗?有必要在这里建立这样的工厂吗?

与台积电或三星等企业竞争并不是最终目的,而是要展开对未来前沿产品的竞争,因为英国正在进行这方面的研究,如果想要商业化,需要考虑到5到10年后的发展方向。这10亿英镑对投资旨在支持我们正在进行的研究,并帮助制定未来5到10年的发展战略,明确我们现在所处的位置、我们正在做什么以及为什么这么做。

但如果英国在未来10年内投入500亿英镑用于并行的芯片计划,那将是自取灭亡,这是疯狂的,因为英国不知道该怎么做。因此,第一步是找出我们擅长什么,这就是我们正在做的事情。我们能够将其提升至价值链的更高端吗?而目前,英国在芯片生产方面的规模非常小,我认为可能不到全球总产量的1%。因此,还有很长的一段路要走,但试图与台积电或三星或SK海力士等企业竞争是愚蠢的。

但是当您在看下一代技术时,没有人占据优势时,就没有赢家,为什么不呢?我的意思是,英国和其他任何国家一样有能力成为未来技术的供应商。并且要记住的是,30年前中国台湾还只是一个小岛,当时台积电成立时并没有电子工业和半导体工业,并且它比英国更小,因此我们是一个小岛并不意味着不能在某个领域成为第一名。

但问题是,我们不知道哪个领域将成为未来的关键?这不是今天的产品,而是明天的产品。这就是为什么研发投资如此重要的原因。但现在的区别在于,研发具有目的性,我们可以用它做些什么?将其发展成为世界一流技术的潜力是什么?

我认为这更多是对未来的一种投资,是踏上未来道路的垫脚石。目前,这可能是第一步,也可能是唯一的一步......这取决于很多事情,但它可能是唯一的一步。如果我们再一次放弃,那么我们会回到最初的起点,但这也可能是迈向未来的一系列步骤中的第一步。

问:你之前说过,现在是时候开始为下一次转变做准备,进行反周期性投资并获得先发优势。那么您能详细说明一下这部分吗?

答:我认为,管理这个周期的唯一有效方式是进行反周期性投资。现在正是建造新工厂的时候,因为两年后工厂才开始投入使用,这正好是行业开始感到供应短缺的时候。届时,你将拥有足够的产能,这样你就能获得其他公司无法处理的所有业务,因为到那时,他们已经没有足够的产能了。

这是管理供需周期的一种经典方式,即在市场下跌时进行投资,在市场上涨时停止投资,这与你的直觉相反,但应该听从你的钱包的建议,因为这意味着当市场加速增长时你将拥有足够的产能来满足需求,而你的竞争对手则需要在同一时间进行投资才能跟上。

然而这种反周期性的投资很难实现,因为你必须要得到股东的允许,如果你能成功进行这样的投资,那么你就是赢家。像韩国的SK海力士、三星以及台积电这样的公司,已经成功地从中获益。

但实际上这很难做到,因为你需要向 股东负责,而他们只会问你:“市场上没有需求,为什么你要花费这么多钱建造新工厂?”这是一个很难回答的问题,除了说“相信我,相信我”这句话外,你需要更强有力的理由才能让他们相信,而单凭“相信我”是无法获得100亿美元来建工厂的。

以下是采访原文(英文):

Q:So compared with other consulting agencies, your forecast for semiconductor market revenue in 2023 was, let's say, the most pessimistic, so what factors in the market make y ou make such a prediction? And also, why is there such a huge difference between agencies when it comes to the forecast?

A:Yes, I think the difference really comes from the fact that we believe that the shortage that we experienced in 2021 and 2022 was fundamentally driven by the fact that there was a mismatch between demand and capacity. And in fact, that's always what triggers the shortages or the excesses. It is that inability to balance supply and demand, because supply is on a very, very long lead time, whether you take the amount of time, it takes to actually make the wafer in the factory, which is typically anywhere from 4 months to even 6 months, and depending on how complex the parties, and even the very simple ones take 3 months.

So you got that long queuing time of actually being able to, if someone orders something which they hadn't previously warned you about, they can't get delivery for at least 3 months, maybe 4, 5 or 6 months, and that's if you have capacity. If you haven't got capacity, then it takes at least 1 year to build a new facility. If you haven't got a building, it takes 2 years. So you know, if you haven't ordered it, you could wait 2 or 3 years before you actually get the parts.

In the meanwhile, the demand doesn't go away. In fact, he gets worse because then people start to over order. They order more than they want. They double order simply because the lead time is too long. And they have to keep their production lines going, so you can't balance supply and demand very easily.

We failed to do that completely over the history of the industry, so you're gonna get these periods whereby suddenly demand runs away with you in the case of 2021, it was because the shutdowns we all had to work from home, we couldn't go out. We all had to buy computers, we bought new televisions, new entertainment systems simply to be enable us to now work from home. And that caused spurs in demand which the industry couldn't deal with, so it immediately tipped into an undersupply situation.

Now the opposite happens like now when suddenly you build more capacity, and it all starts to come online, and then suddenly the customers think, hang on, I'm getting all the parts I needed, but I over ordered, so they cut back and they eat their inventory. And so then you don't need to buy anything because you've already bought it the year before effectively. So that means demand suddenly goes away, which automatically causes over capacity, because now you've got the capacity, and now you haven't got the demand.

Suddenly you got an empty factory or a near empty factory. And then people want to fill the factory, so the first thing they do is to actually reduce the price. So then you have a situation of falling demand, falling average price, and that doubles up together to give you a steep decline in revenue. That's why you always get these steep increases, and these very steep decreases. Simply the correction to where you are in that cycle, so I think that's... and we believe that those corrections are quite steep. And then that's why we felt that you were always gonna get a high double-digit upturn and a high double-digit downturn.

I guess it's that belief and that confidence in that belief which makes us different from other people, other people aren’t may be quite so brave as we are. And they kind of try to temper the bad news by saying it's only gonna be slight or moderate, won't last very long. But in fact, it never does because these are long lead times, and you can't shorten that lead time.

The fact remains is it's just fundamentally part of the DNA, it's part of the way the industry works. We're brave enough to say it, I guess, so maybe some of the others aren't that brave. We're lucky that we're independent, so we don't have a boss to deal with, our boss is our customers. And we can explain to them why we think this, and they can either choose to say whether it doesn't affect me or they can choose to listen.

But at least we are able to stand up. We don't have to answer to a board. We don't have to answer to investors, to shareholders. We don't have to consider those things. We can just say here is how we view the industry, here's what we see, and here's why we come to our conclusions.

Now you can be the judge whether you think we're right or pessimistic or optimistic. And we'll tell you why, and we'll tell you the facts, and we'll tell you what led us to that conclusion. Then we are rich cheeky, because we didn’t show you 17 years or 50 years of history, and show you the previous downturns and the previous upturns, to say, why is it gonna be different this time? What's different, really different this time to make it different this time around.

Q:Last but not least although you have stated that it is still very early to draw the growth figures for 2024, so could you possibly give a rough estimate based on the current market situation?

A:Yes, I mean I think the way if it rolls out, as you would expect it to, you should be looking at a low single digit growth rate number for next year. So if I had to hazard, I guess I'd say somewhere between 4 and 6 % would be a typical type of number for that first year of recovery, increasing quite strongly in the second year into low double digits type of area there.

That would be the normal shape of the recovery curve that you would expect to see and we will know better what exact shape that's going to be when we come to our forecast in September of this year, that's when we will make a firm commitment, but we see that number to be... But I would expect at this point in time here to be in that low single digit range.

Now, if the economy does collapse in the second half of the year, that will push it out slightly, it still has that caveat of we really don't know how this year will roll out, but how the year does roll out will affect the way that the mathematics projects itself forward over that period there.

The actual dynamics behind that won't change. It still will be this gradual rebuilding of inventory, the gradual rethinking of the supply chain, the gradual decrease in excess capacity, the slow increase in average selling prices, all of those things, step by step, slowly accumulate together to give you this increase in value shipment, so it's just a question of whether that happens quickly or slowly.

We believe it will happen kind of in a moderately normal way that will give you this kind of 4 to 6%, maybe 8%, but I doubt it, but certainly a range in the 4 to 6%. So I would expect to see our three scenarios being somewhere between 6%. The forecast, probably in my 4% of the worst case and maybe 10% the really bullish, optimistic case.

Q:That was really helpful, and my third question would be, you have already been through like 15, 16 or 17 critical downturns of the industry. So how would you view the downturn this time? Like a question that was, you know, and what are the implications for the future market?

A:Yeah, I think, as I mentioned earlier, the downturns are always triggered by the same thing, and that is this mismatch between supply and demand. Once you get into an overcapacity situation, then when you're transitioning from an overcapacity to an under capacity or an under capacity to an over capacity, you always get these abrupt changes in the units that we ship to the customer. Not in the demand, because what we ship and what you need is two different things.

It's plus or minus any inventory adjustment as it's happening in between there. The demand they stay the same, but what you're buying, what you're ordering is gonna be very different. It's gonna be what you need plus what extra you want to have for your inventory to keep your supply chain either safe or to cut back on your inventory, because you've got too much stock.

I think you always do get this, and that's typical of every cycle. And this cycle is no different than the 18th will be exactly the same. Until industry manages to balance supply and demand much better. That's quite a complicated issue. I don't know when or how that could actually happen, because it's contrary to the way the industry works.

So I think it is the same, and it is always driven by liquidation of inventory, falling prices. Eventually you liquidate the inventory, so you got to buy more, rebuild the demand that factories start to get full again.

In the meanwhile, you stopped investing because you got too much capacity, so you stop investing. And that starts the very next cycle to go. So I think it's always subtly different, not all products react at the same time. A memory always reacts quickly, then micro, and then logic, and then analog is always the last one to react in the cycle.

Likewise, memory is always first to recover, then micro, then logic, and then analog, and not every sector is different as well. I mean because you find that some sectors that can... the pc, the consumer sectors react much faster. Then, for example, the automotive sector, which is on a much longer, a much more slower, kind of lead time to supply.

I think every sector is different, every product is different, but they all work to the same tune, they're all marching to the same drum. It's just small timing differences that really make the overall.

Q:So also in this recession, so what do you want to say to the investors and also companies from both upstream and downstream in the industry?

A:Yeah, I mean I think the real message is learn the lessons of history. I mean history is a reliable indicator of how behavior will happen in the future. And in general, the world is bad learning the lessons from history. We always want to believe it's going to be different this time. We always believe that there's real reasons why that's going to be the case. But in reality,

it really is different this time, because it is following natural sort of thought processes and natural dynamics. Unless you're changing those dynamics, then the result will not be different. If you want a different result, you have to do something different.

We're behaving in exactly the same way as we have done in the past, so I think the main thing I would say to clients, to investors, to all of the people in the full chain is look at the natural things, don't be over complicated, don't over think it, look to see what is actually happening, where are we in the cycle? What has happened before? How is that likely to affect what's likely to happen in the future?

And I think when you do look at those things there, and you keep those in the back of your mind, all you're looking now for is differences, variances, how does it subtly different? But you got the underlying theme in your mind there, so you're really looking to see how will it subtly and resolve itself in a slightly different fashion this time now. But it's very unlikely as this downturn is showing, I mean, it is rolling out exactly as the previous ones have.

We've had three consecutive quarters now in this is adjustment and their behaving in exactly the same way as every other one of those past 17 downturns has behaved. And so, and the upturn is likely to behave in exactly the same way because eventually we will liquidate the inventory.

We will have to therefore buy more parts, because now we are not living off stock, we're living off what we're ordering, so your orders will automatically increase. That will stop the prices falling, because suddenly demand is going up. So suddenly prices will stop falling, or they may even start to increase.

And if that happens, you get into a positive spiral. And then eventually you will absorb all their excess capacity. And you will suddenly find yourselves “I haven't got enough capacity. That's a 2-year lead time”. So suddenly, you know the whole thing, until we learn to build capacity in anticipation of what we're needing, and you're never gonna be able to try to soften that forward looking of dislocation between supply and demand.

We used to do that, but now we don't, because people can't afford to build an expensive factory and not knowing who they're gonna sell the output to. But customers were reluctant to commit to that output, say, I guarantee to take that in 2 years’ time, because they don't know, so I mean you have an impossible equation to balance.

Q:Okay, great. It's always great, too. To be free to say something without the authorities out there. Also, so my next question would be, you have already made a forecast of a 22% decline in the market revenue in January and March. However, we've also noticed that you slightly put back 2% in May. What factors in the first quarter made you make this call back?

Q:Right, to be truthful, we didn't actually change our forecast. We did counsel that we thought that the original number was actually well within the framework of the accuracy that you can get in any forecast. What we do always is we make a projection what we think is going to be and why then we'll measure what we said against how that year rolls out, and only if something really dramatic happens, will we change our forecast?

Because we believe you should be measured by what you said in the beginning and not by what you keep constantly re-forecasting, because anybody can get the number right if you keep changing it every month. And that's not doing, we believe our clients are justice.

So when we made that 22% forecast, which we asked he made over 18 months ago, interestingly, we were predicting and looking at how that downturn would affect when we get to this situation of supply and demand coming into balance and what would you typically expect the industry to do? And then we reaffirmed it, as you said, in January and March, and we kind of said, yes, we believe that numbers as good as anything.

The real difference at that time was, was it even gonna be negative? I mean a lot of people were saying it wasn't even gonna be negative. Now, the general feeling is it will be negative, but only very slightly, maybe 5 or 6%, something like that. And we still believe it will be a strong double- digit negative growth. Now, it all depends on the math at the end of the day. I mean it is a mathematical situation. We forecast originally that we thought the first quarter would actually shrink by 10%. We had a range there of -8% to -12.5% in terms of what that range was likely to be.

Now, as it happened, the first quarter was slightly stronger. Then our forecast in that it was only -8.2% so that put it much closer to the -8%, which we said was the best end of the scale. The first quarter came in, if you wish, tilted towards the more positive end of our forecast range, but we then said the second quarter was gonna be -6%. And that's not clear yet, because it really you got a mixed opinion out there as to how bad the second quarter is going to be. The thing that really worried me and why we didn't change our forecast was that TSMC they are coming into the forecast that says their sales would decline by 9 anywhere from 9 to 4%, so that's a big range.

-4 to -9 is a huge range to work within. It goes to show the uncertainty that they're facing, and they're a bell whether of the industry overall, if you'd like to say, we do know that we are coming to the bottom of that decline. This decline started in June of last year, so we've had two quarters behind, the three quarters behind us.

The downturns typically last four quarters, so we're in the 4th quarter right now. We expect to see the whole thing come under control and start to readjust and bottom out by the end of this quarter here, so it's really dependent on what that sequential decline will end up being. Will it be -2%, -6%, -8%? It really... we're not sure. So at this point in time, we're saying that it's probably likely to be somewhere in the range of still a -7% type of number of that order of magnitude.

And if it is something like that, our forecast is actually saying -5%. So I think when we're looking at that there, that would take us into like a -20% for the year, it's a small deviation from -22%. But our whole message to industry, it is not gonna be single digit. You cannot get this year to be minus something minus low, -5, -6, even -10%. For it to be that low, you'd have to see the recovery in the second quarter. That isn't gonna happen. The market would have to go positive in the second quarter to get anywhere in a single digit range.

So our view very strongly is that is not gonna happen, because if it was, I mean, it's already June, almost June, so we're nearly at the end of the second quarter, and nobody is raising the flag saying, hey, the markets turn, everything's good, but all the books for over shipping, it's great. Nobody is saying that. So you cannot have a number in the second quarter which is positive. If it's not positive, then the whole year can't be a single digit negative number.

So it's really not just a number. The number is obviously very visible, but it's the message behind the number. That's really important. What is happening? Where are we in the cycle? And where do we expect this to be? And how do we expect it to roll out during the course of the year? That hasn't changed at all for the last 18 months.

And exactly what we said was going to happen is happening, whether it happens to the day or to the week or to the month, that's open to just the dynamics of it. But the actual nature of that downturn, the nature of the recovery that will follow, is following a well-trodden path and following a well-trodden well established industry pattern.

Q:That was this question, I will ask this question first. So you've already indicated that the first quarter of the year is closer to the bull market of the your previous forecast. And the worst -26% is less like, less likely now, so you used to, you still stress that nothing had really changed in substance, so I wonder what does the sense refers to, but what does a... nothing has changed in substance, so what does this part mean? And why do you think it hasn't really changed?

A:Right. The actual inherent dynamics of the industry hasn't changed. The full end of our forecast was driven by the fact that things would economically not deteriorate throughout the period of time, that it would just simply be a very natural progression through the cycle. We had a little bit of uncertainty there, which is why we moved the forecast to be slightly more negative.

In the fact that we were very concerned about the interest rate increases that were happening throughout the world to combat inflation, and the impact that might have on certainly consumer spending power and even businesses, as they were struggling to compensate for the increased interest charges and costs and a squeeze on their disposable income.

That we were concerned that the world might actually slip into recession in the second half of this year. And that's what led to say, if the world did go into a recession at the back end of this year, then you will be pushed closer to the -26%. If the world didn't go into recession and everything was very hunky dory and very positive, you’d be at the -18% of the forecast range there.

I think the difference was really that big unknown “how would the economy react in that time period there?” We felt the supply and demand the all those other issues there, which the industry was in control of will push you towards that middle range there the -22%. But if the economy was slightly stronger, then that will push you slightly to the left. And if the economy was weaker, and did go into a recession into the back half of this year that will push you into the slightly worst case of -26%.

Q:So the big difference really now is what will happen in the second half of this year from a global economic point of view?

And it's still uncertain. I mean it really depends on who you talk to as to whether there's gonna be an issue there or not an issue there. So far America has escaped relatively unscathed and is a strong part of demand. But on the other hand, there's still a lot of uncertainty there.

We've had a couple of minor banking crises. We still got interest rates. Their inflation is still too high, and unemployment is too low. So all of the things that they're trying to address to cool inflation aren't working at the moment, so if they have to accelerate those deaccelerating factors that could easily tilt the world into a recession, and that will have a bit of a snowfall effect around the world.

So it's very unclear, and the economists can't decide, so we still have to push that as a risk, it's not a possibility, it's a risk that needs to be looked at. So our message to investors is you gotta keep an eye on that economic risk. You gotta keep an eye on the capacity risk, because we're still building capacity. Even though we don't need it, we haven't stopped back on capacity.

You gotta look at those two factors there, because they're going to be key determinants there, the more capacity we build now, the longer it's gonna take for it to be absorbed. And the worse the economy gets, the power that is gonna take on demand. So these are the two real unknown wild cards in the equation. The rest of it is coming, is working exactly as plan.

We are liquidating the inventory. It is coming down. The unit shipment is well below the unit demand level that's fixing itself. The prices are bottomed and not declining very much anymore, so they're kind of bouncing along on the bottom there. So it's all those things are working as you would expect them to work. But we just don't know what the demand is gonna be, whether it's gonna take a hit because of an economic downturn in the latter half of this year.

Q:Also about like, like the general environment of the current situation, so you have mentioned before that the most unfavorable factor of the semiconductor in industry in 2022 is the simultaneous increase in production capacity and weak market demand. Do you think the recovery of the first quarter of 2023 would indicate the sky recovery of the market demand? Or does it indicate some changes in the general environment?

A:What I think the reason why the first quarter was not as bad as we thought it was going to be was because that inventory liquidation took a little longer to kind of kick in than it normally did.

I think part of that is due to a couple of structural differences this time around. We had a lot of long-term price and supply agreements in place with customers in the boom years. A lot of companies try to insist on those being on it, and that kind of pushed out when companies were allowed to cut back on their shipments and delayed the inevitable. I mean eventually they were gonna cancel. It's just a question of how long would it be for that to happen, so kind of making customers adhere to a pricing or a unit shipment agreement is a bit of an own goal in a way, because they don't need the parts they've already bought them.

So at one point, in time, they're not going to buy them. And it just pushed it out a little bit, so it took a lot longer for that unit demand to actually go below the trend line, then it would normally have done. And that helped keep the unit shipments after that help keep the value up, so it was a little bit artificial. I think that is now starting to happen with a vengeance in the second quarter. We're starting to see that come down quite dramatically.

I don't think anything has really changed in that regard to make the whole scenario be any real different, and to what it was before, it's just simply a push out due to the fact that we had these long-term price agreements. And I think a lot of sectors like logic, for example, most logic circuitry now is made to water, it's all system on chip type parts, and they all have a long factory lead time. The time in wafer fact, for those is at least 4 months, could be up to 6 months.

That means that even though you wanted to cut back in June or July of last year, you couldn't actually do it because you've already got the factory full of your parts. It just has to you either scrap them and throw them away, or you keep making them until you run out and you only run out in December or January.

Again, it kind of delayed the impact of when you could make this unit adjustment. So that's a structural difference, which is slightly different this time to last time more of the parts being customized. Therefore, you got a factory committed to that part. And the either gets thrown away in which case somebody has to pay for that scrap, or you have to just let it roll and adjust it later on.

Q:I've missed a question, it's about UK Chip Act. So the critic says unbranded as the UK government delayed £1 billion package of support for the semiconductor industry as insignificant. So based on your understanding, what would be your suggestion for the current, you know, the Chip Act of the UK?

A:But I don't think they really called it a Chip Act, because that kind of puts it into the same kind of scenario of what's happening in China and the US and in other parts in Korea, in other parts of the world.

If you compare that $1 billion investment that the UK is putting in compared with the $50 billion in China over three years, in the US over 5 years, in the EU over 10 years. It is obviously insignificant when measured against that. But I think that's an apples and oranges kind of measurement there. But I think what you need to know is to think about is the UK has for a long period of time, actually lacked a strategy for its high-tech businesses, and including semiconductor,

For a very long time, I mean you are literally talking 30 years or something like that. It's kind of supported the R&D, the research to a certain extent. There's a lot of support for research in the UK and after that, research comes an awful lot of technology, which is world class and a lot of it is bought by world class companies because it is good.

But what they're trying to do, I think, with this billion-pound investment, is to try to get a coordination to what are we doing in this research? Can we bring it up one level in terms of turning it into a pilot line to take it to the next level up the value chain and to ask the users to determine what should we be doing? Should we be going into high volume production? Is there a need to have this here?

Not to compete with the likes of TSMC or Samsung with today's products, but to compete at the leading edge for tomorrow's products, because that's where the research is being done in the UK, if you want to commercialize that, you're looking at something that's 5 to 10 years down the road. And this billion-pound is aimed to shore up the research money that's going on, and also to help develop a strategy as to what should we be doing with a UK chip act in 5 or 10 years’ time, where we know now, what we're doing, why we're doing it.

But for the UK to spend 50 billion over the next 10 years on a parallel chip pack would be suicide, it would be crazy, because they don't know what to do with it. So the first step is to find out, here's what we're good at, here's what we're doing. Can we move it up the value chain? And at the moment, the UK is very small. It's probably, I would think, well under 1% of the world production, well under 1%. So you got potentially a long way to go, but it would be silly to try to become a competitor to a TSMC or a competitor to a Samsung or SK Hynix or something like that.

But when you're looking at the next generation of technologies where there is no winner when nobody has a foothold. Why not? I mean the UK is just as capable of being a supplier in the future technologies as anybody else is. And you have to remember, Taiwan was a tiny island 30 years ago when TSMC was founded with no electronics industry and no semiconductor industry, and it's smaller than the UK so just because we're a small island, doesn't mean to say you can't be number one in something.

But the question is, what is that something? And it's not today's product. It would be tomorrow's product. That's why the investment in R&D is so crucial. But now the difference is R&D with a purpose, what could we do with that? What is the potential developing that into a world class technology?

Yes, I think so, it's more of an investment in understanding the future, is a stepping stone. Now it may be the first step and only step in a... I don't know. I mean it depends on lots of things, but it could be the one and only step. And then we go back to giving up, but it could also be the first of several steps.

Q:Great, my last question, you have caught before saying that now it's time to start preparing for the next turnaround and making counter psychological investment and gaining first mover advantages. So could you elaborate more on this part?

A:So I think the only way to really manage this cycle efficiently is to invest counter cyclically. Now is the time you should be building new factories, because then they'll be available in 2 years’ time, that would be just at the time when the industry is going to start to feel under a supply crunch in terms of the not being enough capacity. And you'll be there with your capacity, so you will get all of that business that the other people can't deal with, because they have run out of capacity by then.

So that's the classic way to manage this supply and demand cycle, is to invest when the market is down and to stop investing when the market is increasing, which is counterintuitive to what your heart tells you to do. But it should be what your wallet tells you to do, because that means that you will have capacity when the market is coming to an acceleration and your competitors want, because they want to be invested at that same time.

But that's hard to do because you have to have shareholders who are willing to actually allow you to invest counter cyclically and to do that. But if you do, you will be the winner and companies that do that, I think, certainly the Korean companies, SK Hynix and Samsung tried to do that, TSMC tries to do that, and they are successful. They really do reap the benefits of that.

But it's very hard because you do have a shareholder to answer to. And your shareholders will simply say, why are you spending all this money building new factories when there is no demand? And that's very hard question to answer, except trust me, and trust me doesn't allow you to spend $10 billion. You need a little bit more than just trust me.

评论

文明上网理性发言,请遵守新闻评论服务协议

登录参与评论

0/1000